Challenge

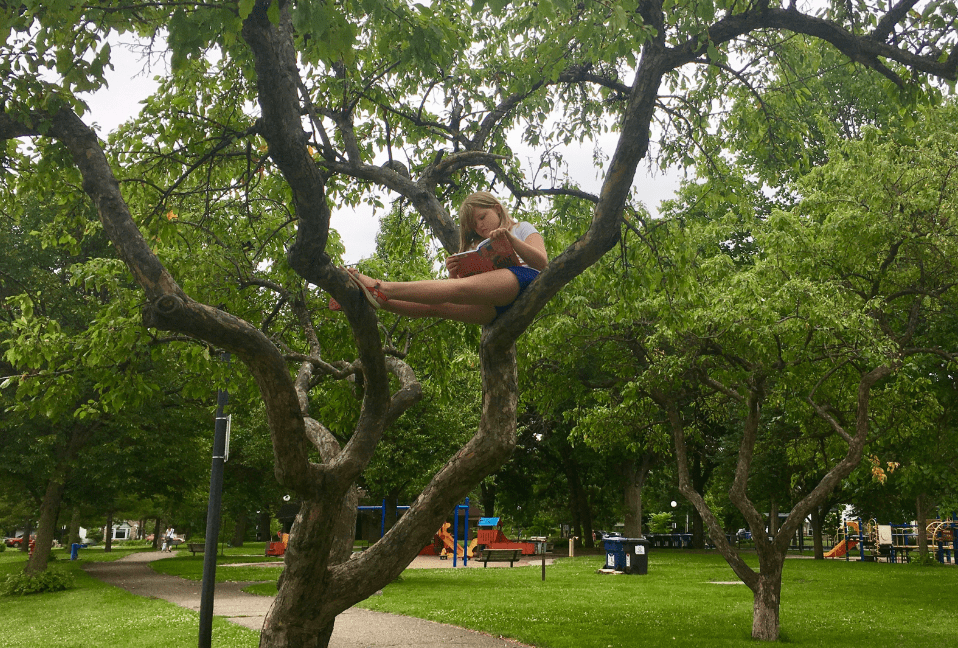

The Minneapolis Park and Recreation Board (MPRB) is a semi-autonomous agency with an independently elected governing body created by the Minnesota State Legislature and popular vote of Minneapolis residents in 1883. The park system is comprised of regional parks and neighborhood parks. Regional parks are larger, have fewer physical amenities and serve a population beyond Minneapolis itself. The parks receive local, state, and federal funding. The 157 neighborhood parks are smaller but host more physical amenities, including 49 recreation centers, two water parks/pools and most of the city’s 397 athletic fields, 112 playgrounds, 121 tennis courts, and 63 wading pools. They serve local residents and receive local funding only.

Funding Action Plan

- General Fund: By state law, the MPRB can levy taxes within certain parameters. The MPRB issues bonds under the full faith and credit of the City. The General Fund is comprised of property tax revenues, local government aid and other revenues. Ninety-six percent of funds coming from the General Fund pay for operating costs, including a fee to the City of Minneapolis for “benefit administration, financial systems, and other services.” The remaining four percent comprise capital expenditures.

- Tree Preservation and Reforestation Levy: The eight-year Tree Preservation and Reforestation levy was established in 2014 to address tree loss from Emerald Ash Borer and storms.

- Enterprise Fund: This self-supporting fund supports business-like operations from golf courses, concessions, ice arenas, permits, sculpture garden, parking operations, and Wirth Winter Recreation. Revenue streams include 68 percent from fees for services, 17 percent from parking an and 15 percent from commissions and rents. Revenue also comes from contracts with private vendors for food concessions, boat excursion, and boat and bicycle rentals for rehabilitation, construction and improvement of enterprise assets, debt service and depreciation.

- Capital Improvement Fund: Revenue’s supporting this fund comes from local, state, regional, philanthropic and federal sources for capital improvements of regional and neighborhood parks and assets. The regional park system receives funding from the Metropolitan Council, the State’s Parks and Legacy Trail Fund, and the Minnesota Lottery in addition to local and federal funding.

Success Builds Upon Success

Funding for neighborhood parks comes via net debt bonds and pay-as-you-go capital funds allocated from the General Fund annual budget, largely from property taxes. Debt Service on the bonds is paid through the annual property tax levy by the City of Minneapolis. The neighborhood park system is currently significantly underfunded by millions of dollars in maintenance, repair, and capital improvement backlogs.